|

<< Click to Display Table of Contents >> APRECPT Receipt Inventory into Stock |

|

APRECPT Receipt Inventory into Stock

|

<< Click to Display Table of Contents >> APRECPT Receipt Inventory into Stock |

|

This screen allows both inventory and non inventory items to be receipted. Inventory items are receipted into stock, non inventory items are not. This receipting process links with the inventory purchase order screen. This stock receipt becomes the supplier invoice which has to be authorised for payment.

Selecting A Purchase Order Nbr

If there is an open purchase order for the supplier, the Purchase Order Nbr: field will be enabled. F5 from this field to select the required purchase order. Multiple purchase orders can be selected by selecting another purchase order.

If after selecting a purchase order, and after the lines have been receipted there still remains open lines on the purchase order, and you want to select these remaining lines through to the same receipt, change the Purchase Order Nbr to zero and <Ctrl + M> to force the records to write. You can then select the same purchase order and the remaining order lines will be receipted.

Selecting An Item From A Purchase Order

When creating a new receipt line, F5 from the PO column and select the order line.

Use Of Unit Cost | Line Value

Unit Cost - The Line Value is calculated Qty * Unit Cost

Line Value - You enter the Line Value and the Unit Cost is calculated.

The default setting is help on the Supplier Table as Supplier Invoice Type.

After selecting a purchase order the default will be Unit Cost. This is on the basis that the initial stock receipt is from a Despatch Docket that most probably shows no costs and the cost will be from the purchase order. When re-editing the receipt the default will be the supplier setting which is best to be Line Value.

Receipting Correct Quantities And Unit Price

It is critical that you receipt inventory with the correct quantities and unit prices.

Example

For an item, the inventory cost is .10c EA, and the Retail Sell Price is .20c EA, and the item is recorded and sold as EA's.

If the item is purchased in packs of 100 then the item MUST be receipted as:

Quantity |

UOM |

UnitPrice |

LineValue |

100 |

EA |

.10c |

10.00 |

It MUST NOT be receipted as:

Quantity |

UOM |

UnitPrice |

LineValue |

1 |

EA |

10.00 |

10.00 |

If the item is receipted as the pack quantity, the Last Cost will be recorded as $10.00 EA and the system will recommend the retail price be increased to $20.00 EA. The moving average cost also becomes incorrect, causing wrong stock valuations.

To prompt users of this possibility, a Warning Window will be displayed if the UnitPrice entered differs from the Last Cost by more than 10%.

Calculation Of Moving Average Cost

For inventory items, if the current quantity on hand is zero or minus, the moving average cost will be changed to the item cost of the stock receipt. You will be asked to confirm that the unit cost value is correct.

A moving average cost is maintained for all inventory items even when the costing method is Last Cost or Standard.

For Cost Of Sales, the product group costing method is used. For items using Moving Average Cost for costing, and the moving average cost is adjusted because of a zero or minus quantity on hand, an adjustment is made to cost of sales for the difference between the previous and current item costs.

Transaction:

Qty |

Value |

QOH |

M.AvgCost |

Value |

10 |

62.50 |

6 -4 |

6.25 7.30 |

37.50 -29.20 |

Cost of sales adjustment calculation:

$7.30 - $6.25 = $1.05 x 4 = $4.20

Freight & Other Charges

These add on costs can be handled in two ways:

| 1. | Add costs to the cost of the items purchased. |

This ensures that the items Last Cost and Moving Average Cost reflect the actual costs

of product into store.

Options:

a) Click on the Freight Button to apportion these costs to the item costs.

b) Select FR as the line type. Only the line cost updates the product cost, the

quantity is ignored.

| 2. | Charge costs direct to a general ledger account - such as Freight Into Store. |

Use a Non Inventory Product Code, such as FREIGHT, and create a line for the freight

value.

GST

GST-Types

E I X S |

GST Exempt Inclusive Exclusive Special GST |

The whole invoice is exempt, no GST is calculated. GST is calculated as a factor of the invoice total. GST is calculated as a percentage of the line value total. Invoice GST is entered manually. |

The GST Amount can be changed if the GST Type is = X or S. The change window is accessed via the Change GST Amount button. The GST Type will be changed to S by the system if the GST amount is changed.

GST O/ride?

This override can be used if:

| • | The supplier is GST registered, but the invoice needs to be GST Exempt. |

| • | The supplier is not GST registered, but the invoice GST Type needs to be I or X . |

Entering a Zero Quantity

Entering a zero quantity is possible if the LineValue type is used.

A zero quantity is required when a price adjustment has to be made. The line comment can be used to record the calculation basis. Also refer to the use of the request for credit.

Default Unit Price

The Unit Price that is selected will be either:

| • | The cost from the purchase order OR |

| • | The item's last cost. |

Note that the item's last cost is created when the purchase order has been authorised for payment.

Allocate To A Job

Transfer in and transfer out inventory transactions are created for inventory items transferred to jobs.

This field can be skipped if required. Refer to Purchasing Options.

Charge Rate Calculation

A charge rate is selected based on the following logic and priority.

| 1. | The Charge Rate on a linked purchase order item. |

| 2. | The Unit Charge Rate for the activity code. |

| 3. | Using the normal sale pricing logic, an item price will be selected based on the |

customer's price type for the job. Any inventory markup for the job will be added to

the price.

If a promo or customerised price is selected, any inventory markup for the job is

ignored.

Customerised discounts will be selected.

| 4. | When a price has not been selected, the Charge Rate will be the Unit Price plus the |

appropriate markup for the job. For a material transaction (JM), the material markup

is applied. For a sub contract transaction (JS), the sub contracts markup is applied.

Changing the value

| 1. | Edit the field directly OR |

| 2. | Activate the Verify Price Selection screen using the Job Pricing button. |

| 3. | To change discounts use the Job Pricing button. |

To Add a Job to a Line

The Quantity has to be zero.

To Remove a Job from a Line with a Linked Purchase Order

| • | Delete the receipt lines. |

| • | Edit the purchase order and duplicate the lines in the purchase order with the Alloc To Job blank and then delete the original purchase order lines - so you end up with the same lines in the PO but without the job. |

| • | Go back to the receipt and select the PO Nbr and the lines and update the receipt - so you have the same receipt lines but with the AllocToJob blank. |

Updating Item Last Cost

The supplier last cost is updated only when the stock receipt is authorised for payment and where the item is purchased for stock, ie if the item is purchased for a job the supplier last cost is not updated.

Changing the Quantity or Line Value

If you want to change the Quantity or Line Value of an inventory item on a Product Receipt, and the current SOH quantity is zero, you will receive a message saying that you will have to delete the line and re-enter the line with the correct values.

So the procedure in this instance will be:

| • | Delete the line. |

| • | F5 (Zoom) from the PO number field on the line, and re-select the PO line. |

| • | Enter the correct Quantity and Line Value. |

Also Purchase Orders

When you create a PO and you notice that the Unit Price for the item is incorrect, you should put the correct Unit Price on the PO, or if you have negotiated a special price you should put the special price on the PO. The Unit Price on the PO is the Unit Price that will come through to the Stock Receipt.

If you change the Unit Cost on the Stock Receipt after receiving the invoice, you DO NOT have to go back to the PO and change the Unit Cost on the PO.

One the PO has been used to create the Stock Receipt it has done its job, so if the Unit Cost on the PO happens to be incorrect don't worry about it.

It is the Stock Receipt that adjusts the moving average cost.

Changing receipts when the invoice is fully paid

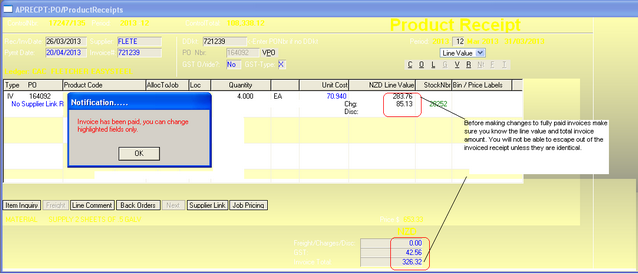

Maxim will allow changes to fully paid invoices provided the total paid invoice amount is identical after the invoice has been updated.

Before making any changes you will need to know the existing line value and total invoice amount. To reprocess the fully paid invoice the current invoice total must match the original value in the above example 326.32. If a change to the type, product code or job is required the current line will need to be deleted.

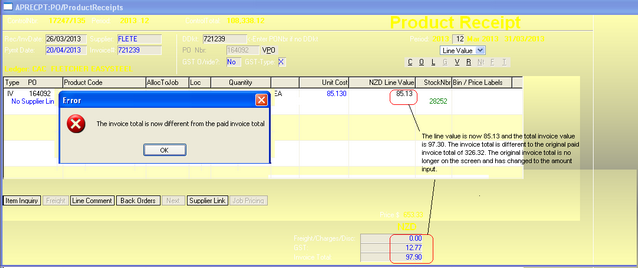

If the new line value and total paid invoice amount are not the same an error message will appear as follows:

To re edit the lines press enter or tab to get down to the receipt lines. You will not be able to escape until the line value total is back to the original amount of 326.32.

As a last resort you could crash out of the screen, if you did not record the invoice total. However you will need to immediately go back to the receipt control and reenter the invoice line value. When you initially go into the receipt the invoice total will display the original value of 326.32. You can recalculate the line value by deducting the GST from the total invoice amount.