|

<< Click to Display Table of Contents >> WIZ15 Pay Suppliers |

|

WIZ15 Pay Suppliers

|

<< Click to Display Table of Contents >> WIZ15 Pay Suppliers |

|

Pay Suppliers Using Payment Batches

When paying creditors you are able to create multiple payment batches without having to commit the payment.

Set Up

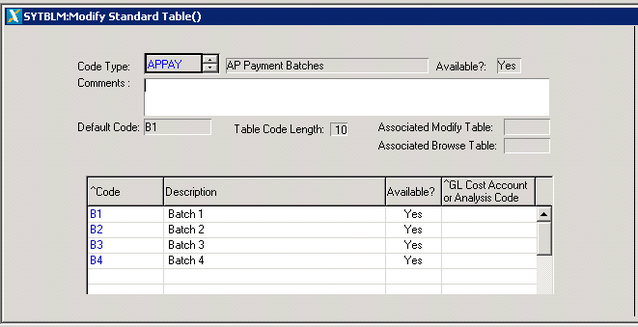

The payment Batches are controlled by a standard table. Maxim will automatically create a standard table called APPAY and it will be populated with B1, B2, B3, B4.

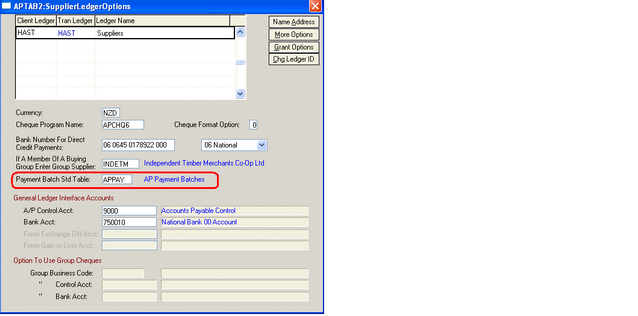

The Payment Batch Std Table has been setup in supplier ledger options.

Pay Suppliers

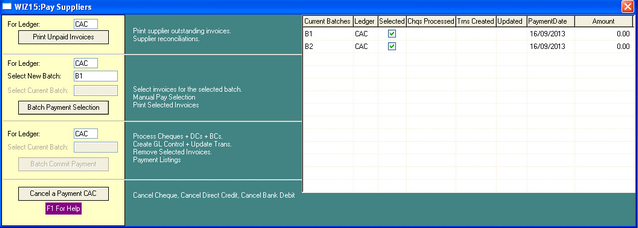

The pay suppliers' process is controlled by the WIZ15 screen. This allows for multiple payment batches to be selected without the need to commit payment. The commit payment function is a separate and independent operation.

If you have multiple ledgers designated in local currency, you can F5 to select the appropriate ledger. Supplier payments can only be made to local currency ledgers through this screen.

]

]

Procedure To Pay Suppliers

The steps to pay suppliers are listed below in logical order. The first step (Print Unpaid Invoices) is not specifically required, but all other steps should be followed in order.

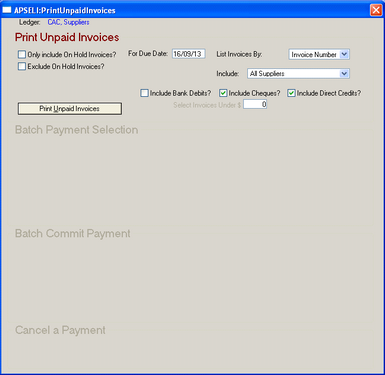

1. Print Unpaid Invoices.

This lists all unpaid invoices for the due date selected. On hold invoices are included. The total amount due is summarised by priority payments.

The following options are available when printing unpaid invoices:

a) Include/Exclude on hold invoices

b) Select by Due Date

c) List by invoice or invoice date

d) If supplier ledger options has Group Supplier Entered, the include:

All suppliers box will be visible. Further options are available to include

or exclude the Group Supplier.

e) Include cheque and Direct Credits are automatically selected.

You can unselect if only one is required.

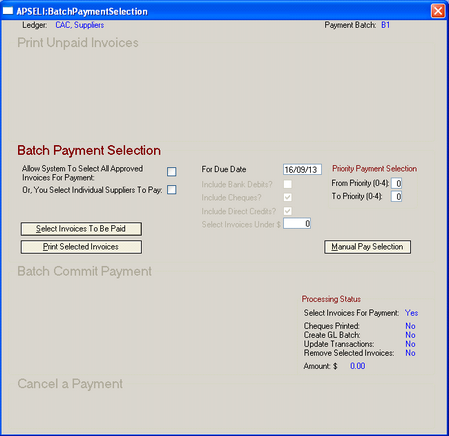

2. Batch Payment Selections

Select Invoices For Payment

Two options exist to select invoices:

1. Allow system to select all approved invoices for payment.

All approved invoices for the due date will be selected. This option is best used when all

or the majority of invoices are to be paid. The Manual Pay Selection screen can be used to

adjust payments.

Selection options:

Include Bank Debits?

Include Cheques?

Include Direct Credits?

These options enable payment runs to exclude payment types if required. Bank Debits are

payments taken directly from your bank account by suppliers. Therefore from a practical point

of view it is best that a separate bank debit payment run is processed, because it will be

necessary that the invoices selected for payment match the payments made from your bank

statement.

Priority Payment Selection

Suppliers can be allocated a Priority For Payment in the range 0 - 4. This allows suppliers to

be selected on the basis of priority, ie:

From Priority To Priority

0 0 Select suppliers with a priority payment of 0

0 2 Select suppliers with a priority payment of 0, 1 or 2

0 4 Select all suppliers

2. Select individual suppliers to pay

No invoices are automatically selected. The Manual Pay Selection screen needs to be used

to select invoices for payment.

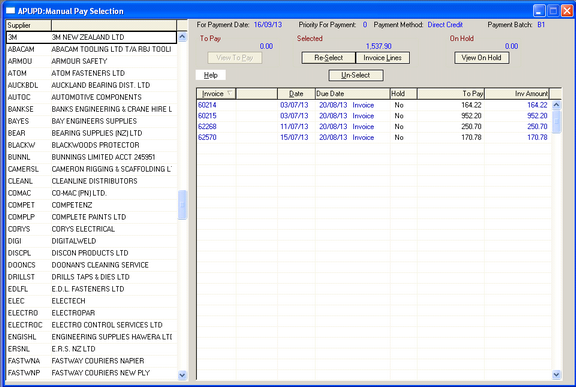

3. Manual Pay Selection Screen

This screen lists suppliers with balances. The suppliers are listed on the left hand of the screen.

View To Pay

All invoices authorised for payment are displayed. Individual invoices can be selected for payment irrespective of the payment due date.

Select

Selects all authorised invoices for the payment due date. Lines selected can be removed from payment <F3> or can be put on hold. The amount To Pay can be changed.

View On Hold

Only authorised invoices can be taken off hold.

See also APSELI: Pay Suppliers Manual Pay Selection

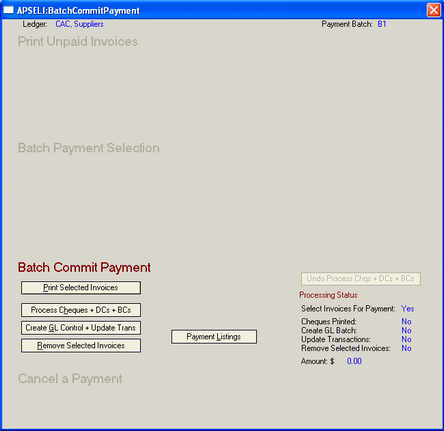

4. Batch Commit Payment

Print Selected Invoices

This report should be run after selecting the invoices for payment. This report lists the invoices selected for payment and should be used to verify and confirm the amounts to be paid.

At this point the cheque run can be aborted. Do this by the Remove Selected Invoices function.

Process Cheques + DCs + BDs

This process will do the following:

| 1. | Print any cheques |

| 2. | Create a file in the designated directory of any direct credit payments. This file is used as input into PC banking for example. |

| 3. | Create remittance advices for any direct credit payments or any bank debit payments. |

see also APCHQS - Process Cheques and Direct Credits

Payment Listings

Prints a listing of payments made.

Create GL Batch and Update Transactions

This process creates the general ledger transactions and the payment transactions for the invoices paid. It is important that you select the correct accounting period. The accounting period required is the period relating to the payment date.

Before committing this process, all cheques should have been printed and the direct credit file verified 'Okay'. Preferably upload the direct credit file to your PC banking software. Cheques and direct credit file cannot be reprocessed once this has been run.

Remove Selected Invoices

The Remove Selected Invoices function deletes the payment file.

Logic to Protect Selected Invoices Integrity

Invoices selected for payment are placed into a payment file. While invoices are held in this payment file the invoices cannot be edited and a new transaction cannot be created with an invoice number that matches a suppliers invoice number held in the payment file.

Cancel Cheque, Cancel Direct Credit, Cancel Bank Debit

These screens enable a payment to be reversed. All the necessary transactions are created and no manual journal entries are required.

To authorise invoices for payment use the APPAY: Authorise Payment to Supplier screen.